- What does the CCUS ITC cover?

- What is not covered by the CCUS ITC?

- What is the value of the CCUS ITC?

- What does the CCUS ITC project plan look like?

- Does the CCUS ITC change based on the performance of a project?

- How is dual-use equipment treated by CCUS ITC?

- What are a CCUS ITC recipient’s reporting requirements?

Introduction

The Carbon Capture, Utilization, and Storage Investment Tax Credit (CCUS ITC) is a Canadian federal tax incentive introduced in 2021, designed to stimulate the deployment of CCUS projects.

The CCUS ITC is available for eligible projects in Canada constructed between January 1, 2022, and December 31, 2040. Eligible CCUS projects may claim ITCs on capital costs as they acquire and install equipment.

Three parties are involved in developing, legislating, and implementing the CCUS ITC:

- Finance Canada is responsible for formulating tax policy as well as drafting and developing tax legislation and regulations.

- Natural Resources Canada (NRCan) is responsible for evaluating CCUS project plans, focusing on property eligibility and design.

- The Canada Revenue Agency (CRA) is responsible for managing CCUS ITC claims and administering the investment tax credits.

CCUS projects need to apply, verify equipment acquisitions, uses, and eligibility with NRCan. Before accessing the CCUS ITC, projects must understand various non-financial and operational requirements. An extensive review of several documents is required to understand the nuances of the CCUS ITC requirements, including:

- NRCan’s summary of the CCUS ITC;

- The CCUS ITC Technical Guide; and

- The Income Tax Act (the enabling legislation for investment tax credits) – primarily but not exclusively

- Sections 127.44 and 211.92

- Definitions in the Income Tax Regulations.

This resource is designed to support general understanding of how the CCUS ITC works. Project developers should rely on the source documents when making project decisions. Those interested in any clarification on the materials NRCan has published regarding the CCUS ITC can contact the CCUS ITC inbox at [email protected].

What does the CCUS ITC cover?

The CCUS ITC has conditions on what costs are eligible. Rules regarding the eligibility of capital expenditures under the CCUS ITC are critical to project viability in Canada.

Eligible Recipients

CCUS ITC recipients must be taxable Canadian corporations, including relevant partnerships. This excludes Crown corporations or non-taxable Indigenous community owned enterprises. Credits may also be recaptured by the CRA if a project is eventually sold to an ineligible party during the expected course of the project. Projects that began operating prior to 2022 and/or coal -fired electricity generation facilities are considered ineligible.

Designated Jurisdictions

The CCUS ITC is only available in provinces that Environment and Climate Change Canada (ECCC) has recognized as having fully developed carbon storage regulatory frameworks, or “designated jurisdictions.” Only Alberta, British Columbia, and Saskatchewan are designated jurisdictions, while Manitoba, Ontario, and Quebec have taken steps to develop carbon storage frameworks and eligibility under the CCUS ITC.

Capital Expenditures

The CCUS ITC is designed to cover capital expenditures, not just simply equipment costs. This includes costs associated with legal, accounting, engineering, physical property, delivery, installation, testing, material, labour, overheads, and other related fees. It excludes activities defined as preliminary CCUS work activities.

Eligible Expenditures

Eligible expenditures are separated into four categories defined by descriptions in the Income Tax Regulations Capital Cost Allowances (CCA) Class 57 and Class 58 (with exceptions), and the Income Tax Act’s definition of dual-use equipment.

Each of the categories must be part of a qualifying CCUS project and includes all physically and functionally integrated equipment, dedicated ancillary equipment, safety and monitoring systems, and infrastructure that solely supports support CCUS processes. Some equipment that partially supports CCUS processes, but also other industrial processes, referred to as dual-use equipment, may be at least partially eligible for the CCUS ITC. NRCan determines eligibility for the CCUS ITC on a case-by-case basis.

| Category | Definition |

|---|---|

| Qualified carbon capture expenditures | Defined in CCA Class 57: Capital expenditures solely used to capture (carbon dioxide) CO2 |

| Qualified carbon transportation expenditures | Defined in CCA Class 57: Capital expenditures solely used to transport CO2 |

| Qualified carbon use expenditures | Defined in CCA Class 58: Limited to capital expenditures solely used for equipment that uses CO2 in concrete |

| Qualified carbon storage expenditures | Defined in CCA Class 57: Capital expenditures for equipment solely used to permanently store CO2 |

| Dual-use equipment expenditures | Defined in the Income Tax Act: Includes equipment that does not solely support CCUS processes |

CCA Classes and the CCUS ITC

CCA classes are categories of properties that can be deducted from businesses’ taxes at a depreciating rate over several years. Four CCA classes have been created specifically to support CCUS projects.

- Class 57 (8% depreciating CCA rate): Equipment used solely to capture, transport, or store CO2.

- Class 58 (20% depreciating CCA rate): Equipment solely used for CO2 in industrial production.

- Class 59 (100% depreciating CCA rate): Intangible property used to evaluate geologic storage opportunities. This includes environmental studies or community consultations.

- Class 60 (30% depreciating CCA rate): Intangible property used for drilling, converting, or completing a well for CO2 storage sites. This includes technical designs, feasibility reports, or proprietary modelling.

Tax deductions using CCA rates are separate and ‘stackable’ with the CCUS ITC.

CCA Classes 57 and 58 are used in the Income Tax Act to define equipment that qualifies for the CCUS ITC. Class 58 equipment is not tied to eligible uses, meaning equipment used for EOR is a Class 58 expenditure, but ineligible for the CCUS ITC. Conversely, most dual-use equipment would not be Class 57 or 58 equipment but may be proportionally eligible for the CCUS ITC.

Demonstration and Pilot Projects

A demonstration or pilot project that is designed to operate temporarily may not be eligible for the CCUS ITC. Eligible CCUS projects are expected to capture CO2 for at least 20 years.

Interaction with Other Investment Tax Credits

The CCUS ITC is one of several Clean Economy ITCs developed by Canada to spur investment in projects that support the transition to a net-zero economy. Specific pieces of equipment can only be eligible for one of the Clean Economy ITCs. However, a project, like a hydrogen production facility that captures and stores any produced CO2, can choose which equipment would receive either the Clean Hydrogen ITC or the CCUS ITC. In Budget 2024, the Government of Canada announced the design of a Clean Electricity ITC, which would provide a 15% credit for natural gas power generation with capture projects once fully legislated. This credit is expected to primarily support CCUS projects that are not eligible for the CCUS ITC, particularly those led by non-taxable entities such as Crown corporations.

Interaction with Other Funding Sources

The CCUS ITC can generally be stacked with funding from other sources, with the exception of other Clean Economy ITCs. Other key incentives for CCUS projects in Canada can be explored here.

What is not covered by the CCUS ITC?

The Technical Guide gives a list of properties that are considered ineligible expenditures by the ITC when coupled with a CCUS project. However, this list is not exhaustive, and there may be opportunities for specific properties to be included on a case-by-case basis, determined by NRCan. Processes such as hydrogen production, natural gas processing, oxy-fuel combustion or other processes that happen prior to the capture of CO2 are generally ineligible. Similarly, expenses before the construction phase of a project are also ineligible.

- Preliminary CCUS Work Activities: Exclusions include costs incurred for obtaining permits, performing front-end design or engineering work, conducting feasibility studies, environmental assessments, or clearing/excavating land.

- Hydrogen Production Equipment: For the CCUS ITC. These technologies include methane reforming and related technologies. Additionally, equipment used to treat or purify hydrogen is ineligible. Such a project will also be required to refer to the Clean Hydrogen ITC. More information can be found on their webpage.

- Natural Gas Processing Equipment: This includes equipment for oil and condensate removal, dehydration, natural gas liquid separation, and hydrogen sulfide removal. Equipment used for acid gas injection is also excluded from the CCUS ITC.

- Oxy-fuel Combustion Equipment: All oxygen production equipment is also excluded from the CCUS ITC, regardless of its intended use within the CCUS project. While some equipment in an oxy-fuel combustion process may be eligible, many types of equipment are not.

Indirectly Related Infrastructure

Non-pipeline transportation infrastructure, such as roads, highways, and railroad tracks, does not qualify for the CCUS ITC. Trucks, vehicles, and other vessels used to transport materials, consumables, and process waste (excluding CO2) within the CCUS process are generally ineligible. Buildings and other structures that do not meet the “all or substantially all” threshold for a CCUS process are ineligible. Similarly, in the case of a CCUS retrofit, buildings and structures are only eligible if they are essential to support the addition of CCUS equipment for a project.

What is the value of the CCUS ITC?

As an investment tax credit, projects must make claims as they file taxes. The CCUS ITC has different rates and rules that impact what the value of credits that can be claimed.

The value depends on:

- What aspect of the CCUS value-chain equipment or property is going to be used for;

- Whether CO2 is being captured from an industrial facility or the atmosphere;

- When specific equipment is installed in the project;

- What the captured CO2 is going to be used for; and

- How a project approaches the ITC’s labour requirements.

Maximum rates for the CCUS ITC

The maximum CCUS ITC credit values apply to expenditures incurred for equipment received and installed between January 1, 2022, and December 31, 2035. Claimable rates are halved for projects after January 1, 2031 until December 31, 2040. To maintain the maximum ITC rates over the length of the project, all captured CO2 must be used for eligible uses (dedicated geological storage or verified storage in concrete) and all labour requirements must be met.

The maximum rates for eligible capture, transportation, storage, and utilization expenditures are:

- Direct Air Capture (DAC): 60% of CAPEX for projects that capture CO2 directly from the ambient air.

- Point Source Capture: 50% of CAPEX for projects that capture CO2 from other sources, preventing its release into the atmosphere.

- Transportation, Utilization & Storage: 37.5% of CAPEX for transportation and utilization expenditures that move, use, and/or permanently store captured CO2.

Development and refurbishment ITCs

The CCUS ITC rates are different before and after the first day of commercial operations for eligible expenditures. For the CCUS ITC, the first day of commercial operations is 120 days after the captured carbon is first stored or used. Claims prior to this date, referred to as development CCUS ITCs, are unlimited for eligible expenditures. Claims afterwards are considered refurbishment CCUS ITCs.

Refurbishment ITCs are capped at 10% of qualified expenditures incurred before the first day of commercial operations. For example, if a project had $1 billion in qualified expenditures before operations, the maximum refurbishment credits claimable during operations would be $100 million.

Eligible uses of CO2

To be considered an eligible use, captured CO2 must be injected for dedicated geological storage or utilized for concrete production using a qualified storage process. Conversely, utilizing CO2 for EOR, other utilizations, or releasing captured CO2 back to the atmosphere are ineligible uses. For capture and transportation expenditures, eligible use percentages are used to determine the value of ITC eligibility. For carbon use and storage expenditures, captured CO2 must be used for eligible uses only.

| Category | Eligible Use Impact |

|---|---|

| Qualified carbon capture expenditures | Reduced by the proportion of captured CO2 stored via ineligible uses |

| Qualified carbon transportation expenditures | Reduced by the proportion of captured CO2 stored via ineligible uses |

| Qualified carbon use expenditures | Equipment must support CO2 stored via eligible uses only |

| Qualified carbon storage expenditures | Equipment must support CO2 stored via eligible uses only |

| Dual-use equipment expenditures | Depends on where in the CCUS value-chain the dual-use equipment is used (eligible equipment is mainly used to support capture processes) |

In a project plan, developers must indicate an expected eligible use percentage. That percentage is multiplied by the value of the capital expenditure to determine the value eligible for an ITC.

For example, an eligible $1 million capital expenditure for a point-source capture project is projected to use 50% of captured CO2 for EOR, the following ITC value would be calculated:

Projects are required to track their actual eligible use percentage over the operations of their project. If ineligible uses are more than 5% higher than their projected value, the CRA will charge a recovery tax that uses the difference between expected and actual eligible use percentages. Continuing the above example, if the project’s actual eligible use was 40% over the entire project, the CRA would charge a recovery tax equivalent to:

Since the project would have initially claimed more tax credits before the actual eligible use percentage was known, the project would end up with a $200,000 ITC after deducting the recovery tax.

The recovery taxes are applied after each project period (typically 5 years) and are prorated for that period. ITCs are only clawed back for periods when actual eligible use is lower than expected.

Recovery taxes may be accelerated if eligible use falls below 10%. In such cases the actual use is deemed to be 0% for that and all future periods. The CRA will then apply recovery taxes equal to 100%, 75%, 50%, or 25% of the claimed ITCs if ineligible CO2 use exceeds 90% in the first, second, third, or fourth project period, respectively.

Recovery of CCUS ITCs from the sale of CCUS equipment

The CRA may recover ITCs if a project sells or exports property that was part of a CCUS project and used to claim tax credits. If the sale or export occurs before the first day of commercial operations, the property is treated as entirely ineligible, and 100% of the claimed ITCs must be repaid. If the sale happens between the start of commercial operations and the subsequent ~20-year reporting period, a recovery tax is applied using a formula that includes:

- The ITC expenditure claimed for the property.

- The ITC rate (e.g. 50% for point source capture equipment).

- The sale price value of the property.

- The original value of the property.

- Any amounts repaid for that property previously.

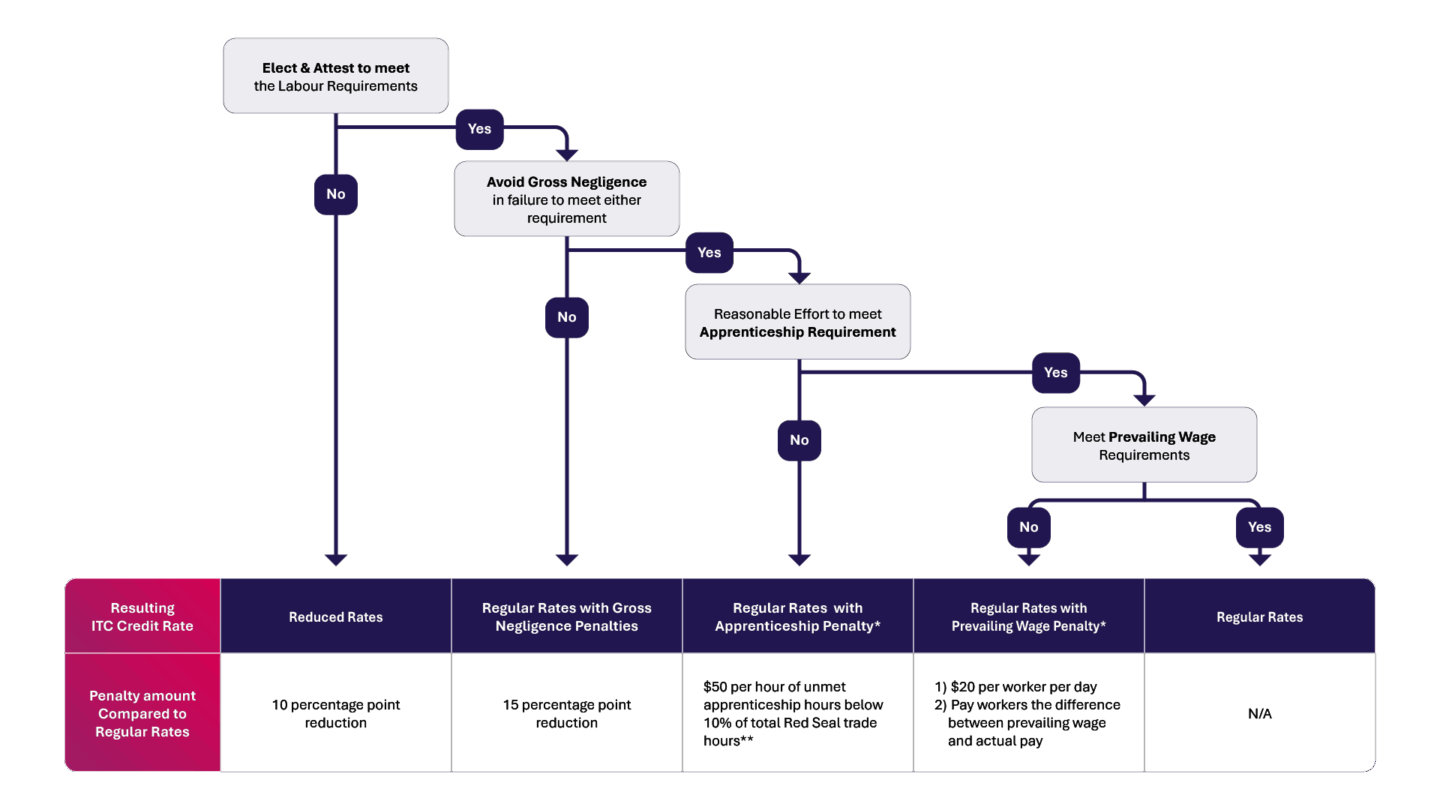

Labour requirements

CCUS projects that began after the Fall of 2023 must meet labour requirements. To receive the full CCUS ITC rate, projects must declare their intent to meet the labour provisions and comply with prevailing wage and apprenticeship requirements. The purpose of the requirements is to ensure that workers on CCUS projects, receiving the ITC, are paid at levels at or above similar collective bargaining agreements and, where possible, that 10% of the project’s workforce are apprentices.

Failing to meet the labour requirements will result in reductions to the applicable tax credit rates. These labour requirements apply to specified property prepared or installed on or after November 28, 2023.

As an example, a DAC project may be eligible for ITCs up to 60% of capital costs. Although choosing not to meet labour requirements would lower the value of the credits by 10 percentage points, to 50% in this case. If a project commits to these requirements but grossly neglects its commitment to meet them, projects may be penalized by the equivalent of a 15-percentage points rate deduction.

These labour requirements and penalties are summarized below:

| Prevailing Wage Requirements | Apprenticeship Requirements |

|---|---|

|

Compensation: Covered workers must be paid (excluding overtime but including benefits) equivalent to a relevant eligible collective agreement.

Communication: The prevailing wage requirements must be communicated to employees. |

Work Hours: Recipients must make reasonable efforts to ensure apprentices work at least 10% of the total hours. Reasonable Efforts: Every four months, a project must:

Exceptions: Reasonable efforts are not required if laws or collective agreements limit the proportion of apprentices. |

What does the CCUS ITC project plan look like?

| Years from Final Investment Decision | Actions for project developers to access the CCUS ITC |

|---|---|

| -3 years |

Determine Eligibility:

Identify Claimable Development Credits:

|

| -2 years |

Complete:

Submit Project Plan for Evaluation:

A project plan can be submitted up until commercial operations, but claims can’t be made until initial evaluation from NRCan |

| Positive Final Investment Decision (FID) Announced | |

| +1 to 2 years |

Construction Begins:

|

| Expected project life +20 years |

Commercial Operation Begins:

|

What is a project plan and how is it evaluated?

During the project plan submission process, the CRA determines whether a project is classified as a single or multiple CCUS project. NRCan reviews the project plan, including the CCUS process and property, and determines whether the property qualifies under the CCUS ITC. Operators may be required to provide additional information. NRCan’s decisions on project approval and eligible expenditures can be appealed for reconsideration.

Project plans must be submitted before the first day of commercial operations, and project operators are unable to claim CCUS ITCs without an initial project evaluation issued by NRCan.

The project plan package will primarily consist of a FEED study. If the project is already in the construction stage at the time of applying for the CCUS ITC, relevant detailed engineering documents must also be provided. Each project plan needs to include:

- Project objectives and scope

- Design parameters and considerations

- Key performance indicators (including capture efficiencies, CO2 captured, usage, and avoided)

- Budgets

- Process flow, utility flow, piping and instrumentation, and electrical one-line diagrams

- Including delineation of equipment use and ownership

- Equipment lists

- Energy and material balances

- Site plans

- Class 3 (if submitted during the FEED stage) or Class 1 (if submitted during construction stage) capital cost estimates

- A project schedule with major milestones (Level 3 AACE Schedule)

- Dual-use equipment calculations

- Demonstration of pore space access

- Letters/agreements with cross-CCUS-chain partners

- Eligible use of captured CO2

Project plans are also broken into four project periods (typically 5 years long). These periods play a primary role in calculating the value of credits, as they relate to eligible use percentages and the potential for recovery of ITCs.

How does the CCUS ITC treat phased projects?

CCUS projects can differ in structure, ownership and timing. Some may include all parts of the CCUS value chain (capture, transportation, and utilization/storage) while others focus on a single part. The CCUS ITC accommodates phased development, assessing each phase based on eligibility criteria at the time it is placed in service. Different parts of full-chain projects may also have different owners. Projects may also be completed in phases or at once.

To manage the eligibility of projects and recipients of ITCs, the CRA, in consultation with NRCan, determines the number of projects within the submitted project plan. This evaluation is used to recognize the phased development of CCUS projects.

For instance, a CCUS project may have one large transportation and storage system, tied to multiple capture facilities, each built in sequence. In this case, it would be likely that the construction would be executed in phases with varying starts to the project’s commercial operations. If the entire project were considered a single project, after the first day of commercial operations at one capture facility, all subsequent construction related to a CCUS project would only be eligible for refurbishment credits (limited to 10% of pre-operations capital expenditures). Conversely, if each of the phases were broken down into different projects, each project would be eligible for developmental credits until each capture project was operational.

The CRA assesses on a case-by-case basis whether a project plan constitutes as a single project or multiple projects. Key factors considered include:

- Ownership: Different owners of the CCUS segments in a value-chain may suggest that there are multiple CCUS projects, rather than a single project with one owner.

- Location: Existence of multiple distinct sites of the same type, such as CO2 storage, capture, or emission source sites, may indicate multiple CCUS projects depending on the integration between sites.

- Capacity: Mismatched capacities between segments, for example, an oversized CO2 pipeline built to serve multiple capture sources can be a sign of multiple project

- Phased Construction: Segments built in distinct phases may be treated as separate projects.

- Start of operations of CCUS segments in a CCUS value chain: Misalignment of start-up dates may indicate multiple projects.

- Significant expansion of capacity: If an existing CCUS project undergoes a significant capacity expansion, such as adding a new CO2 trunk line or storage hub, it could be considered a new CCUS project.

- Written agreements: Such as partnership, joint venture agreements, or contracts between CCUS capture and transportation/storage segments, can be reviewed to assess the level of interconnection and interdependence, helping to determine if the CCUS value chain consists of a single project or multiple projects.

Outside of the financial aspects of a project, converting a large project into smaller projects may result in different reporting requirements as some reports are only required for projects that exceed a capital expenditure threshold.

Does the CCUS ITC change based on the performance of a project?

The value of the CCUS ITC is not affected by the capture efficiency or availability of the facility. The primary reasons that tax credits could be recovered are related to using captured carbon for ineligible uses, or aspects related to the disposition and/or sale of the property that received ITCs.

The CCUS ITC is flexible when it comes to circumstances that are beyond the project developer’s control, such as natural disasters. Projects can request that NRCan apply emergency circumstances rules if the project is unable to use captured CO2 for eligible uses from no fault of their own.

The CCUS ITC includes a shutdown clause. If a project is inactive during a period, no tax credits are repayable for that time. Partial inactivity excludes only the inactive portion from eligible use percentages.

How is dual-use equipment treated by CCUS ITC?

Equipment that supports both an industrial process and a CCUS process may qualify for the CCUS ITC under the Dual-use Equipment category. For this, both eligibility and value is determined by its proportional use for supporting CCUS processes. Dual-use equipment includes equipment that generates and distributes utilities such as power, heat, and water for both industrial processes, and CCUS processes like capture or compression.

To determine the eligibility and value of the CCUS ITC for dual-use equipment, project developers need to calculate two factors related to each piece of equipment:

- The Dual-use Factor, which is a threshold that determines if the equipment is considered an eligible for the CCUS ITC; and

- The CCUS Factor, which determines the proportion of dual-use equipment CAPEX eligible under the CCUS ITC.

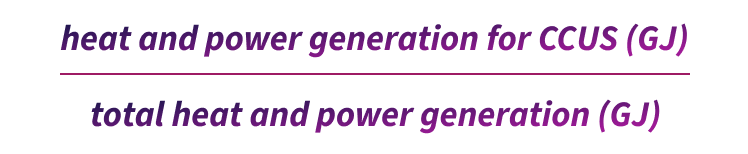

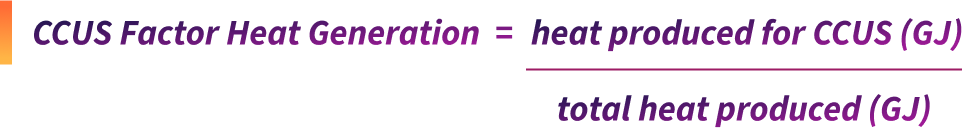

The biggest difference between the dual-use and CCUS factor calculations, is that the Dual-use Factor can include other uses to support clean economy (primarily hydrogen) activities. For example, for heat generation equipment, the dual-use factor calculation is:

While the CCUS factor only includes the proportion of heat production used for CCUS against the total amount of heat produced.

Dual-use equipment for heat and/or power generation, and power transmission, must have a dual-use factor that exceeds 50%.

All values used in the CCUS and Dual-use Factor calculations must be based on the most recent project plan. Additionally, all values should be calculated as expected totals for the total CCUS project review period (from commercial operations for ~20 years), accounting for variable plant operations such as maintenance downtime.

| Dual-use Equipment and CCUS Factor Calculation | Dual-use factor requirement | Other requirements |

|---|---|---|

|

Heat generation: Includes combined heat equipment and ancillary equipment

|

Must exceed 50% |

Heat recovered from the CCUS process to be reused is not included in calculations Fossil fuel emissions from the heat generation must be captured |

|

Power generation: Includes combined power equipment and ancillary equipment

|

Must exceed 50% |

Fossil fuel emissions from power generation must be captured Power generation for CCUS includes electricity used by project equipment or sold via a direct agreement to another CCUS project on the same grid |

|

Combined heat and power generation: Includes combined heat and power equipment and ancillary equipment

|

One of heat OR power dual-use factor must exceed 50% |

Equipment must generate both heat and power Heat recovered from the CCUS process to be reused is not included in calculations Fossil fuel emissions from the dual-use combined heat and power generation units must be captured |

|

Power distribution: Includes substations and distribution points, and connecting power lines

|

None |

Power lines are assigned the CCUS factor for the secondary substation or distribution point they power Power used by the distribution equipment is not accounted for in the calculation |

|

Power transmission: Includes transmission lines and equipment

|

Must exceed 50% | Disregards power used by the transmission equipment |

|

Heat distribution: Equipment that transfers heat from Generation to various uses

|

None | |

|

Water handling: Equipment that supports the delivery, collection, recovery, treatment and/or recirculation of water

|

None |

What are a CCUS ITC recipient’s reporting requirements?

If recipients meet specific spending thresholds, there are three major reporting requirements for CCUS ITC:

| Annual progress reports | Knowledge Sharing Reports | Climate Risk Disclosure Report | |

|---|---|---|---|

| Submitted to | NRCan | NRCan | CRA |

| Required by | Annually after project plan evaluations from NRCan | The first 5 years after project start-up | Annually for 21 years after start-up |

| Financial threshold | None | Qualified expenditures exceed $250 million or more | Qualified expenditures exceed $20 million or more |

| Penalty for non-compliance | N/A | $2 million |

Lesser of: $1 million or 4% of the total CCUS tax credit received each year before the report’s due date. |

Annual progress reports

After submitting a project plan, each operator is required to submit annual progress reports that will include updates on project milestones, information on changes to the project, and anticipated claims to the CRA. The identified property is then evaluated by NRCan which supports the CRA to process tax credit claims.

Knowledge sharing reports

NRCan requires CCUS ITC projects with qualified expenditures that exceed $250 million over the project’s lifetime to contribute to public knowledge sharing knowledge sharing reports. The reports share the key lessons from construction and completion of project and the performance and adjustments made during the early stages of operation. NRCan hosts these reports on their website, available for public viewership.

There are two types of knowledge sharing reports:

| Construction and Completion Knowledge Sharing Report | Annual Knowledge Sharing Reports | |

|---|---|---|

| Due date | Within 1 ½ years from the start of commercial operations | Each of the next four years |

| Contents |

|

|

The knowledge sharing reports will include detailed sections related to decision rationale, best practices, and lessons learned. These insights are invaluable for future projects in a similar way to the Alberta Government’s Knowledge Sharing Program.

What will projects need to share?

The construction, completion and annual knowledge sharing reports consist of:

Summary Reporting

To communicate the project’s benefits, impacts, and lessons learned, using this format:

| Executive Summary | A brief summary of the entire report. |

|---|---|

| Introduction | A description of the project scope, objectives, and purpose, the construction period, the stakeholders involved, and the nature of any partnerships. |

| Background | Information on the project’s context, including previous work, the project’s necessity, or the gap it addresses. |

| Description of Process and its Application | An overview of the CCUS project and process design, including a diagram or schematic, the industrial sector, the source and industry of the captured CO2, transportation methods, destination, and measurement, monitoring, and verification systems. |

| Results and Performance | A description of the key results that have been or will be achieved through the CCUS project. |

| Lessons Learned | A description of the challenges faced, how they were overcome, sector-specific considerations, best practices, changes to the project scope, and the knowledge gained. |

| Impacts and Monitoring | An assessment of the project’s environmental impacts and its contribution to greenhouse gas emissions reduction. |

| Benefits and Outcomes | A summary of the project’s outcomes, its significance, barriers to replication that have been reduced, opportunities for replicability, revenue streams, and jobs created. |

CCUS Segment-Specific Reporting

Segment-specific reporting will communicate rationales, best practices, methodologies, and lessons learned at a more granular and process specific level compared to the summary reporting. The following elements should be included in this part of the report:

|

CCUS Project (To be completed by all projects) |

Schedule: Including timelines, milestones, challenges, and lessons learned for different components of the project. Stakeholder Engagement: A list and summary of stakeholders consulted, and lessons learned. Permitting: A list of standards, consents, and permits relevant to the construction of the CCUS project. Procurement: A description of the procurement of technology, infrastructure, and services provided by Canadian vendors and businesses. Canadian Content: If international vendors or businesses were used, provide a justification as to why they were used in procurement. Also provide an estimate of the proportion of the CCUS project supplied by Canadian vendors and businesses. |

|---|---|

| Capture |

For projects including carbon capture, this includes:

|

| Transport |

For projects including captured carbon transportation, this includes:

|

| Storage |

For projects including captured carbon storage, this includes:

|

| Utilization |

For projects that utilize captured carbon, this includes:

|

Key Metrics

| Source Emissions |

Annual CO2 emissions generated by the source(s) to be captured Annual CO2 emissions captured |

|---|---|

| CCUS Process Emissions |

Annual CO2 equivalent (CO2e) emissions generated by process Annual fugitive CO2 emissions during process |

| Material Use |

Average thermal energy consumption Average electric energy consumption Average scope 2 CO2e emissions from energy consumed Average water consumption |

| Costs |

Average cost of CO2 capture Average cost of CO2 avoided |

| CO2 Storage |

Annual CO2 stored in dedicated geological storage Annual CO2 stored in concrete Annual CO2 stored through other ineligible means (EOR or other utilizations) Average rate of CO2 stored in concrete |

Climate risk disclosure reports

If a project expects to incur $20 million or more in qualified CCUS expenditures the owners of the projects must complete an annual climate risk disclosure report. Climate risk disclosures must be publicly posted on the project developer’s website every year after the first CCUS ITC is claimed until 21 years after project operation starts.

The annual climate risk disclosure report shall describe climate–related risks and opportunities in:

- Corporate governance

- Impacts on business and strategy

- Risk management processes

- Metrics used to assess climate related risks

The report must also explain how the project developer’s actions contribute to Canada’s Paris Agreement commitments and net-zero emission goals.