Giving the greenlight to carbon capture, utilization and storage (CCUS) projects is complex but a necessity in the race to meet our climate goals. We did our research and created Getting to Final Investment Decisions, a 60-page report designed to help you understand a project’s journey, using Alberta’s success as a prime example.

Now, we’re breaking it down further into bite-sized blogs!

The fourth post in our series breaks down the cost and revenue factors that matter most when deciding whether to invest in a CCUS project.

Part 4: The Business Case for CCUS: Is it worth it?

Investing in carbon storage solutions is good for the environment and can be an important part of a company’s long-term sustainability strategy, but is it good for business?

A compelling business case for a CCUS project must address the biggest question: Can the value from investing in CCUS outweigh the cost of investing that capital elsewhere? Most executives will agree – it must make dollars and sense.

In our Getting to FID Report, we dive deeper into the cost and revenue factors that shape investment decisions. But we have also summarized the key points for you here, along with additional resources to help you build a strong business case.

Costs

Part of a CCUS project’s financial viability is evaluated through capital and operating costs. Megatonne-scale CCUS projects can reach multibillions of dollars, leaving emitters to weigh the associated costs of these projects against other capital projects and other emission reduction strategies.

There are many key factors that influence costs for large-scale CCUS projects:

- Type of industrial process: Each industrial process has different CO2 emission sources, flue gas characteristics and challenges to tackle when integrating a carbon capture unit into an existing facility. These impact the efficiency and cost-effectiveness of carbon capture. Click here to learn more about how these factors vary between industries and how they contribute to the complexities of carbon capture

- Capture technology: The capture technology selected influences the capital and operating cost of capture projects. There are a growing number of capture technology options available (e.g., liquid amines, solid adsorbents, membranes, cryogenic, calcium looping, etc) each with different energy requirements and varying costs. Many researchers and companies are pursuing innovation to reduce costs and are piloting new methods that may be less energy-intensive and more cost-effective than what is currently commercially available. Click here to compare and learn more about available capture technologies.

- Flue gas characteristics: The concentration of CO2 and presence of impurities in the flue gas affects how easy (and expensive) it is to capture CO2. Click here to understand how detailed flue gas characterization can reduce costs, increase capture rates and optimize the operation of a carbon capture system.

- Energy costs (heat and power) and integration: Carbon capture is energy intensive and the market price of heat and power impacts operational costs. Evaluating thermal integration opportunities or reusing heat from one part of a system, can reduce operating costs but can add scope complexity and increase overall capital cost for the project.

- Impact to industrial facilities production and operation: Understanding how a carbon capture facility impacts the existing industrial facility is critical. Integrating capture technology can influence aspects of production, including energy consumption, process efficiency and maintenance schedules, which can impact costs.

- Transportation and storage: Costs will vary based on the transportation method selected, the distance between a capture facility and storage site, and whether the storage site is located onshore or offshore (more expensive). Access to shared transportation and storage infrastructure can help to reduce costs for an individual capture project. To learn more about CO2 storage and transportation options, refer to the Getting to FID Blog 2.

Revenue and Incentives

To justify the capital investment behind these projects, business cases should show clear potential of returns or offsets. At this time, direct revenue streams mainly come from government initiatives. Ultimately, governments want companies to implement CCS because it helps achieve international and national climate goals. In turn, they’ve created policies, regulations and programs to incentivize large emitters to get on board.

These initiatives will either generate revenue and/or reduce costs. Some key revenue sources in Canada include:

- GHG pricing system/Carbon credits: This allows CCS projects to generate revenue through verified credits that can be traded for a financial return or used to avoid paying a price on emissions. The largest trading systems used by CCS projects in Canada to develop credits are Alberta’s Technology Innovation and Emissions Reduction Regulation and the federal government’s Clean Fuel Regulation. The Canada Growth Fund has also signed carbon offtake agreements which can guarantee a return on the carbon credits generated.

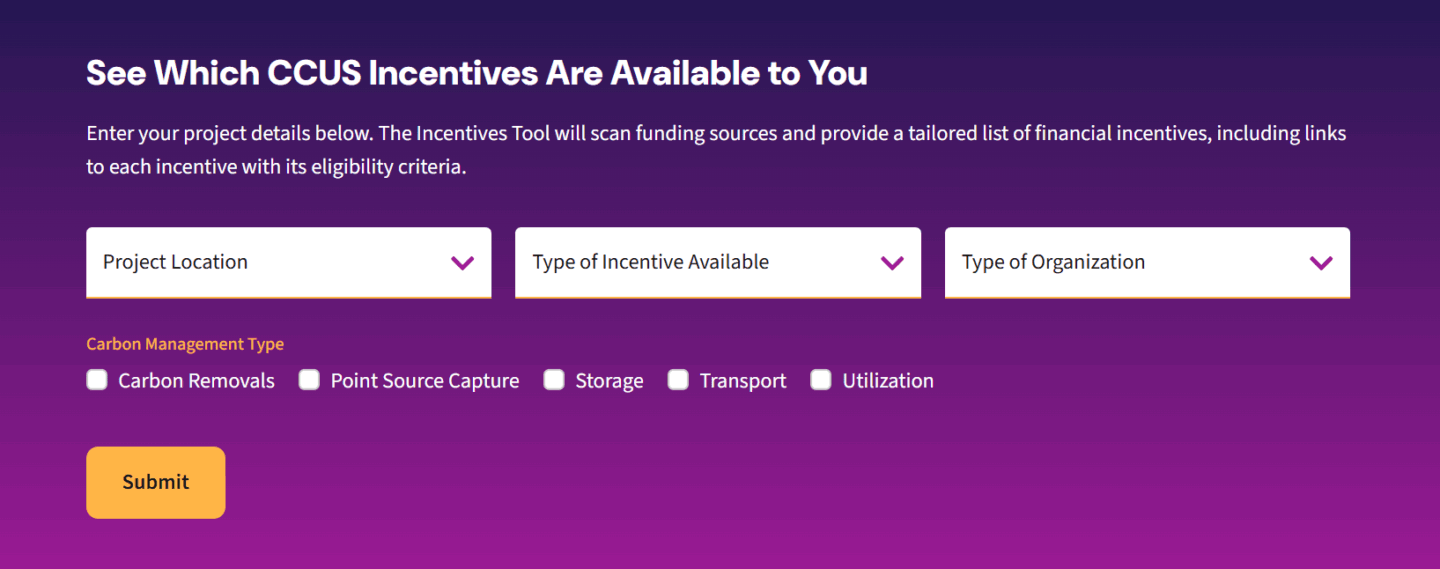

- Grants and financing programs: In Canada there are various grants and funding opportunities to incentivize CCUS projects (to navigate the various funding options in Canada refer to the Canadian CCUS Incentives Tool). The CCUS Investment Tax Credit (CCUS-ITC) – a federal government tax incentive – is one of the largest incentives available which refunds up to 50% of capital investment on point-source capture related equipment and up to 37.5% for transportation and storage projects. Timing is an important factor with this policy as the tax incentive is halved for 2031 to 2040 (timeline in effect at the time of evaluation), impacting the value proposition for CCUS projects looking to take advantage of this incentive. Read our ITC Guide to learn more about this incentive.

- Utilizations: Another way to generate revenue is to use the captured CO2 for the creation of low-carbon products (CO2 utilization) or Enhanced Oil Recovery (EOR). However, there are some challenges with these options such as:

- EOR: Suitable locations for EOR represent a small fraction of the needed storage volume for scale in North America, and EOR is not viewed as an acceptable solution in many regions of the world. In Canada, EOR is not recognized as an eligible use to access the CCUS-ITC.

- CO2 utilization: Three key challenges remain for the low-carbon product market including scalability, competitiveness and climate benefits. Refer to Table 8 for more on these challenges.

Whether the revenue will exceed costs for CCS projects will vary on a case-by-case basis. For viable projects, each company is going to have a different expected rate of return, risk tolerance and ability to adapt operations to implement CCS technologies. The financial viability of future CCS projects requires certainty on incentives and continued innovation investment to reduce costs.

Cost reductions will need to build on the lessons learned from previous projects – especially from first-of-a-kind facilities and novel technology applications. We share in Section 3.3 how knowledge sharing is an important tool in reducing costs and strengthening the overall business case for CCUS going forward.

We’ve created a Canadian CCUS Incentives Tool to help navigate funding options in Canada – access it here.

HYPOTHETICAL SCENARIO

Learn more about the potential and currently open government revenue sources for a capture facility at a petrochemical plant storing CO2 in Alberta – set to begin operation in 2027.